PowerHouse

PROJECT TYPE

User research + market validation

YEAR

2021

Problem statement: The goal was to determine market validation for PowerHouse, a plug-and-play, prefabricated solar array, in order to assess consumer demand for the product.

Process: While working at Northeastern University Marketing Association Consulting (NUMAC), I led a team of 5 marketing consultants. We embarked on a comprehensive process to gather insights and validate consumer interest in PowerHouse. This involved analyzing previous surveys and conducting interviews with 12 solar consumers in both the residential and commercial target markets.

During the interviews, we collected valuable user insights by delving into consumers' preferences, needs, and opinions regarding PowerHouse's product. The information obtained from these interviews served as a crucial component in assessing consumer desire and determining market validation.

Solution: The analysis of previous surveys and the extraction of user insights from the interviews allowed us to validate the consumer interest in PowerHouse's product. By understanding the desires and needs expressed by the interviewed solar consumers, we were able to confirm the demand for a plug-and-play, prefabricated solar array that offers flexibility, easy installation, and the ability to maintain the aesthetics of properties.

These insights provided important validation for PowerHouse and helped inform the company's marketing and product development strategies moving forward. The findings supported the value proposition of the product, indicating that there is a consumer market seeking the benefits and features provided by PowerHouse's innovative solar array.

PowerHouse's Management Decision Problem (MDP)

How can we validate/ prove there is consumer desire in PowerHouse’s commercial and residential product segments?

PowerHouse's Research Problems (RPs)

RP1: Consumer Perceptions: Investigate target market attitudes towards solar energy

Residential sector

Commercial sector

RP2: Consumer Behavior: Evaluate how the target market perceives PowerHouse’s product line

Residential sector

Commercial sector

RP3: Competitive analysis: Evaluate how the target market compares PowerHouse to its competitors

Secondary Research - Insights

I conducted a miro workshop where the team did a Rose, Thorn, and Bud exercise. Here the team listed out what they were able to learn, what they were not able to learn, and what they hoped to learn during exploratory research about PowerHouse through the secondary data available to us. Depending on their research problem, each member of the team used a different color while adding stickies to the three categories.

The team further consolidated these insights into the following:

Primary Exploratory Research: Interviews

We created an interview script for the residential and commercial segment consisting of 14 questions covering RP 1-3. The interviewee would first answer questions about the current energy sources and their reasons for their preferences which would be followed by questions based on renewable and sustainable energy. Once the idea is introduced, the interview becomes more solar-focused where we asked the interviewees questions on whether they had ever installed solar in the past and the factors that went into that decision.

Towards the end, we asked questions about product features and aesthetics of competing solar products to gauge their perceptions of different solar products including PowerHouse.

Research Findings

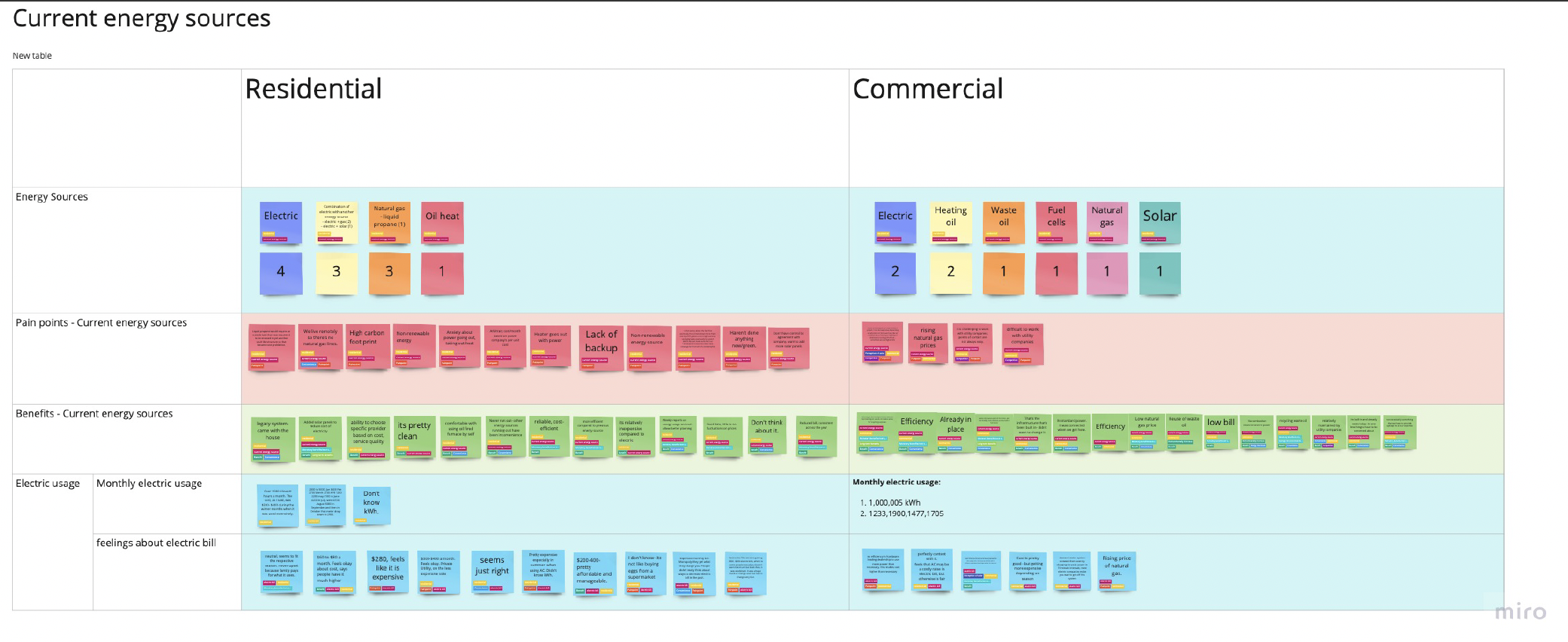

We interviewed 12 people- 8 residential and 4 commercial from Austin, Texas, and parts of Massachusetts as per PowerHouse's target market. In order to do a comparison of the answers provided by users for the particular question, the team worked on the following excel document. It consists of details of the interviewee and answers to questions from the script.

After this, we created a table to add all the key findings and quotes mentioned during the interviews to each of the questions provided in the script.

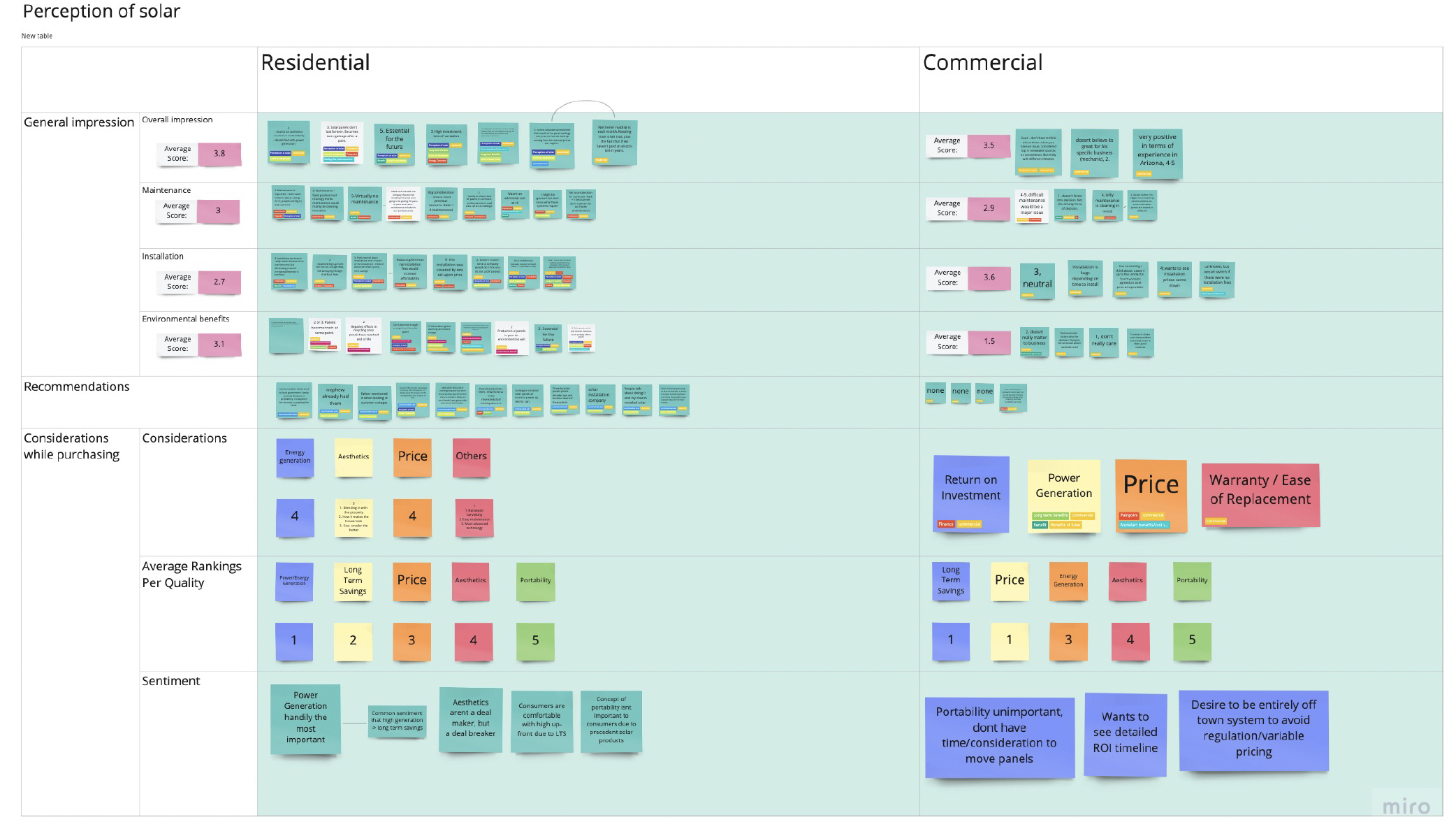

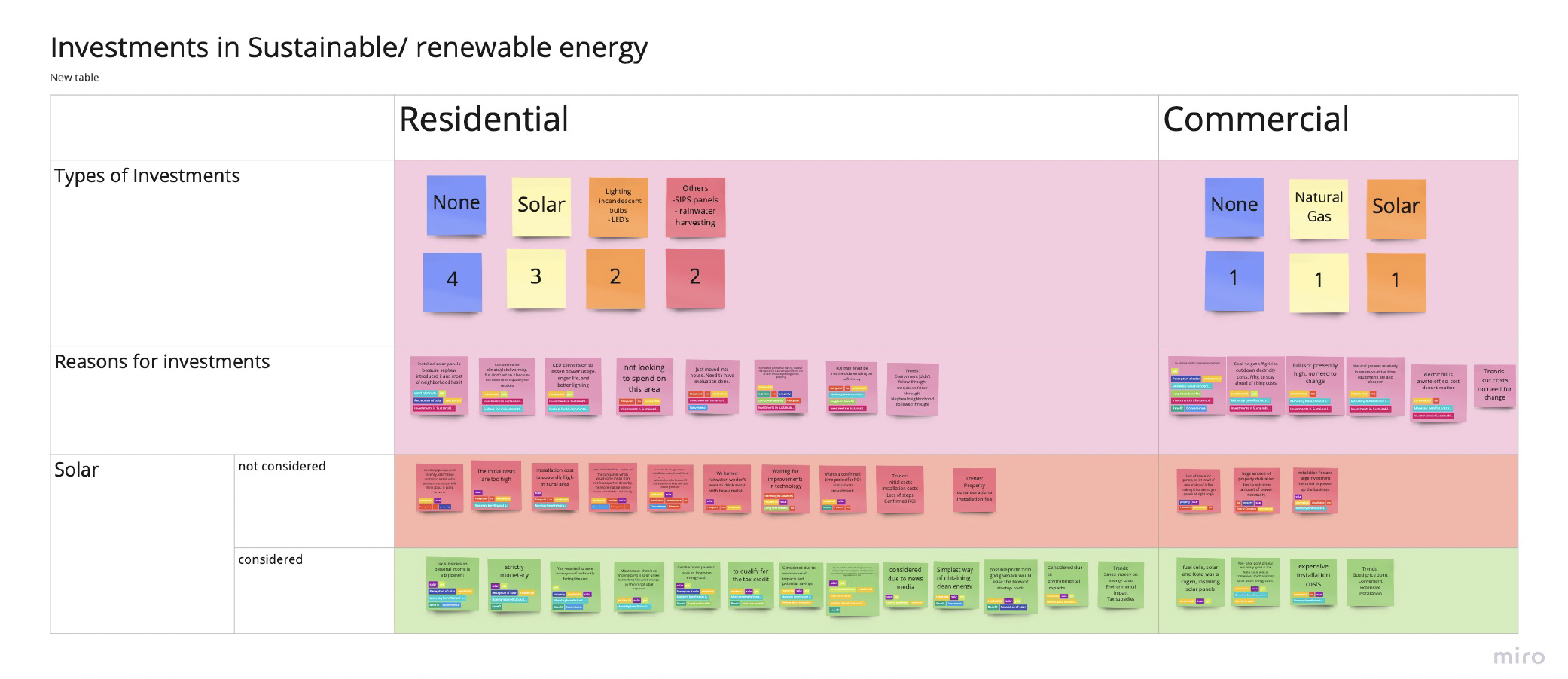

Research Insights

In order to make sense of the research findings, the team came up with categories to organize the data:

Current energy sources

Investments in sustainable and renewable energy

Perception of solar

PowerHouse product perception

Competition

To analyze the data, we tagged each of the stickies with keywords associated with it. For example:

Added solar panels to reduce cost of electricity

This is tagged as a residential, current energy source, benefit, monetary benefit/cost saving, long term benefit.

Similarly, other stickies were tagged based on their product segment, whether it’s a pain point or benefit (or neither), the category of finding it belongs to, and any additional information.